san francisco gross receipts tax instructions

Businesses operating in San Francisco pay business taxes primarily based on gross receipts. The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Payroll Expense Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax.

San Francisco Payroll And Gross Receipts Tax Liability 101 Youtube

These online instructions provide a summary of the applicable rules to assist you with completing your 2018 return.

. City and County of San Francisco Office of the Treasurer Tax Collector 2020 Annual Business Tax Returns. This tax also known as the LLC fee is required in exchange for the privilege of operating in California. Article 12-A of the San Francisco Business and Tax Regulations Code provides rules for determining San Francisco payroll expense.

This additional tax burden only applies to LLCs in the state. Administrative and Support Services. The San Francisco Office of the Treasurer and Tax Collector Tax Collector has released a form for taxpayers to request a two-month extension of time to file their Gross Receipts Tax.

The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax. San francisco gross receipts tax instructions 2020 Tuesday February 22 2022 Edit. The City began making the transition to a Gross Receipts Tax from a Payroll Tax.

The San Francisco Office of the Treasurer and Tax Collector Tax Collector has released a form for taxpayers to request a two-month extension of time to file their Gross. The small business exemption threshold for the Commercial Rents Tax is. To begin filing your 2020 Annual Business Tax Returns please enter.

The San Francisco Office of the Treasurer and Tax Collector Tax Collector has released a. For entities and combined groups with San Francisco-sourced gross annual receipts of over 50 million the Homelessness Gross Receipts Tax imposes an additional rate. The Homelessness Gross Receipts Tax is applied to combined San.

The City began making the transition to a Gross Receipts Tax from a Payroll Tax. Gross Receipts Tax Applicable to Private Education and Health Services. Estimated SF Gross Receipts The estimated.

E The amount of gross receipts from retail trade activities and from wholesale trade activities subject to the gross receipts tax shall be one-half of the amount determined under Section. Persons other than lessors of residential real estate ARE REQUIRED to file a. The Gross Receipts Tax small business exemption threshold is 2000000 of combined gross receipts within the City.

You ARE ENCOURAGED to file if your 2020 payroll expense was less than 320000 or gross receipts was less than 1200000 AND you made estimated quarterly payments. And Miscellaneous Business Activities. The Homelessness Gross Receipts Tax is applied to San Francisco taxable gross receipts above 50000000.

Businesses operating in San Francisco pay business taxes primarily based on gross receipts. The San Francisco Office of the Treasurer and Tax Collector recently issued Gross Receipts Tax regulations tax return filing instructions and other.

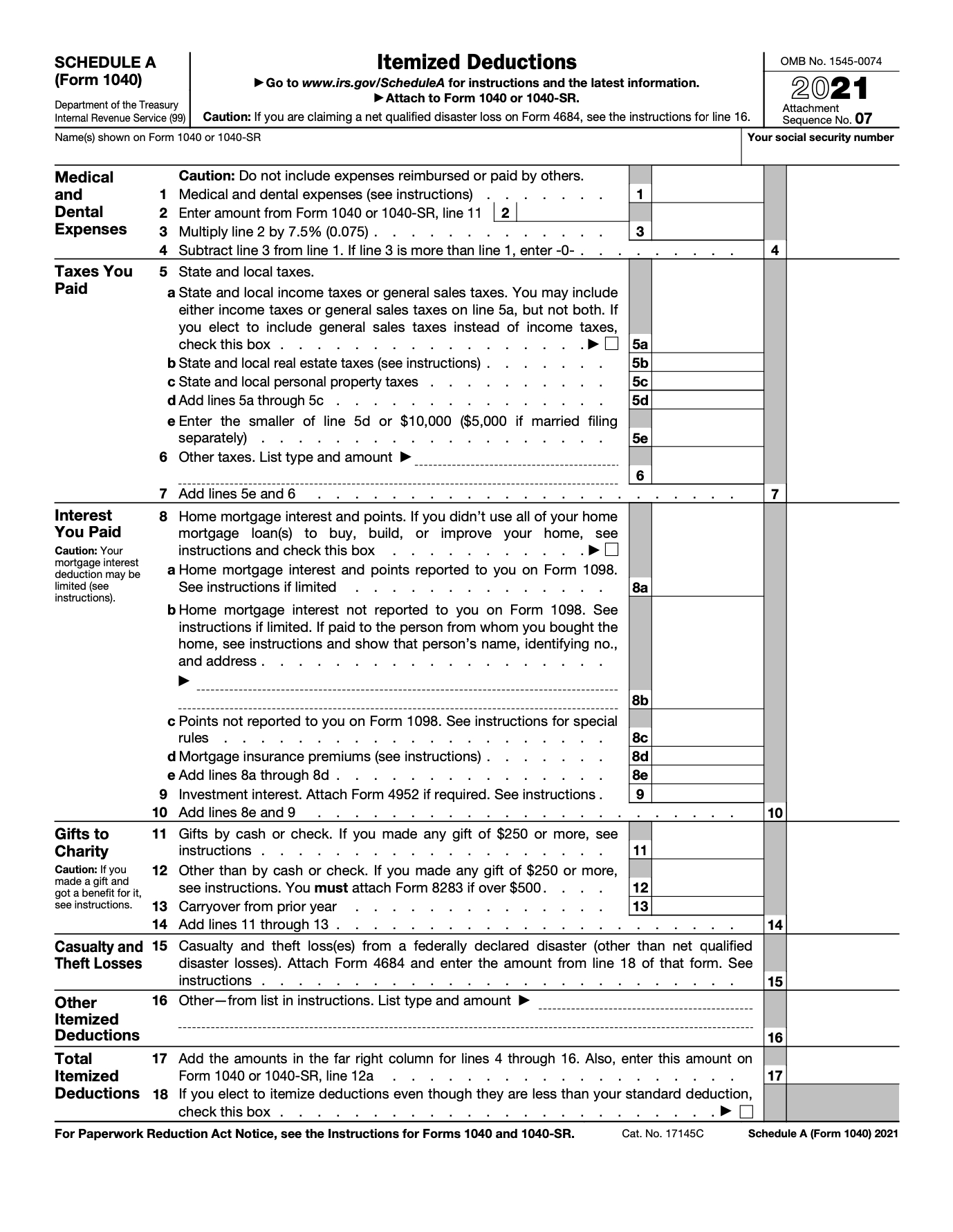

Schedule A Form 1040 Itemized Deductions Guide Nerdwallet

California San Francisco Business Tax Overhaul Measure Kpmg United States

San Francisco S Biggest Companies Now Forced To Pay A Homeless Tax

Gross Receipts Tax And Payroll Expense Tax Sfgov

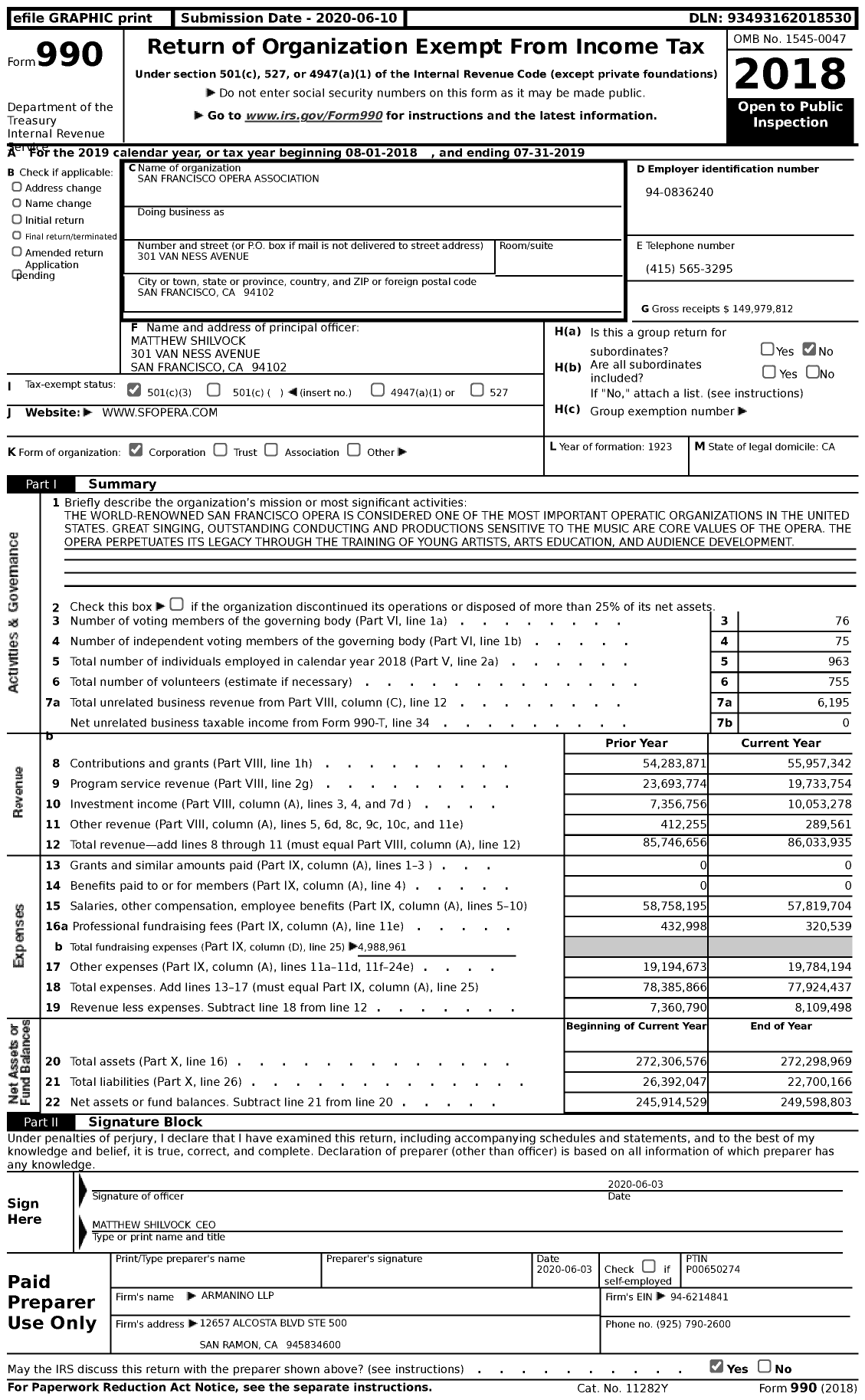

2019 Form 990 For San Francisco Opera Cause Iq

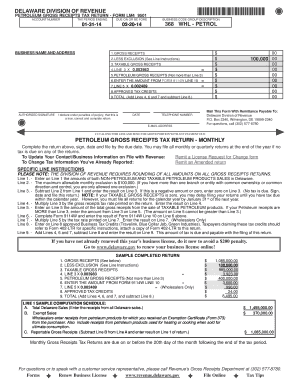

Fillable Online Revenue Delaware Petroleum Gross Receipts Tax Return Form Lm4 9501 Revenue Delaware Fax Email Print Pdffiller

Gross Receipts Taxes An Assessment Of Their Costs And Consequences

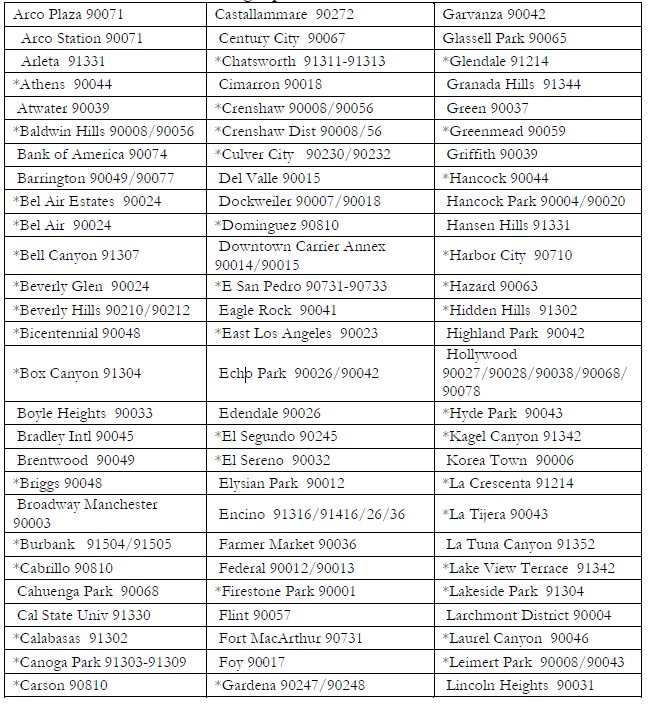

Special Considerations For Los Angeles Business Taxes Filing Due On March 2 2015 Corporate Tax United States

Understanding Small Taxpayer Gross Receipts Rules

Wait How Would Louisiana S Gross Receipts Tax Work Tax Foundation

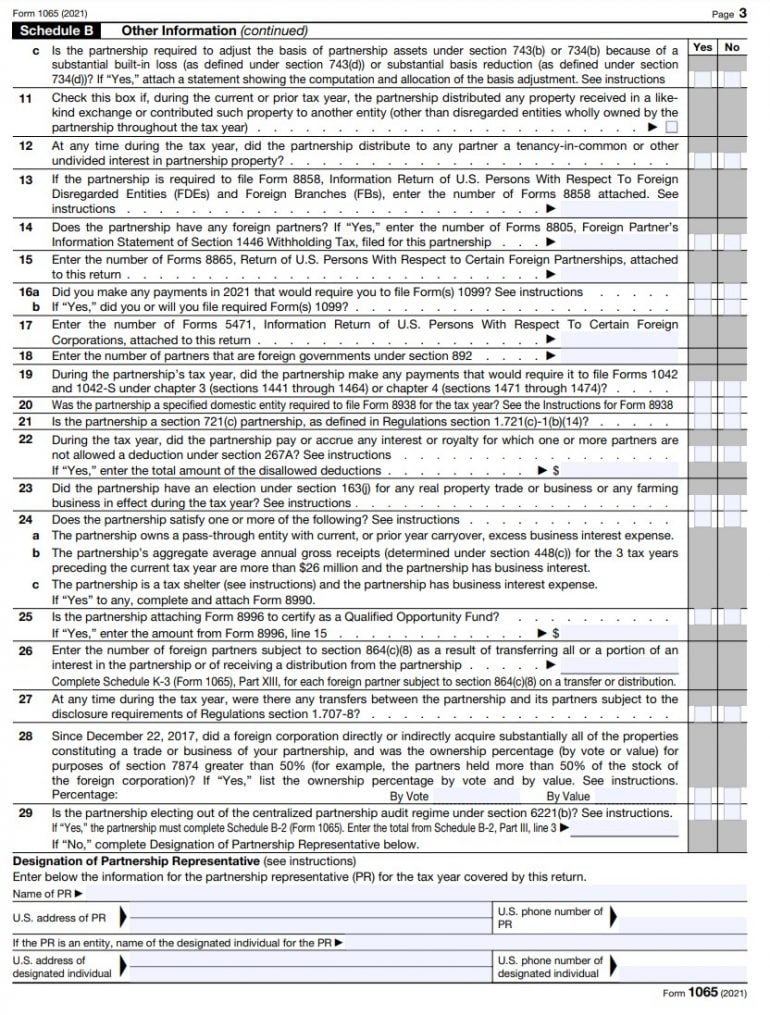

Irs Form 1065 Instructions Step By Step Guide Nerdwallet

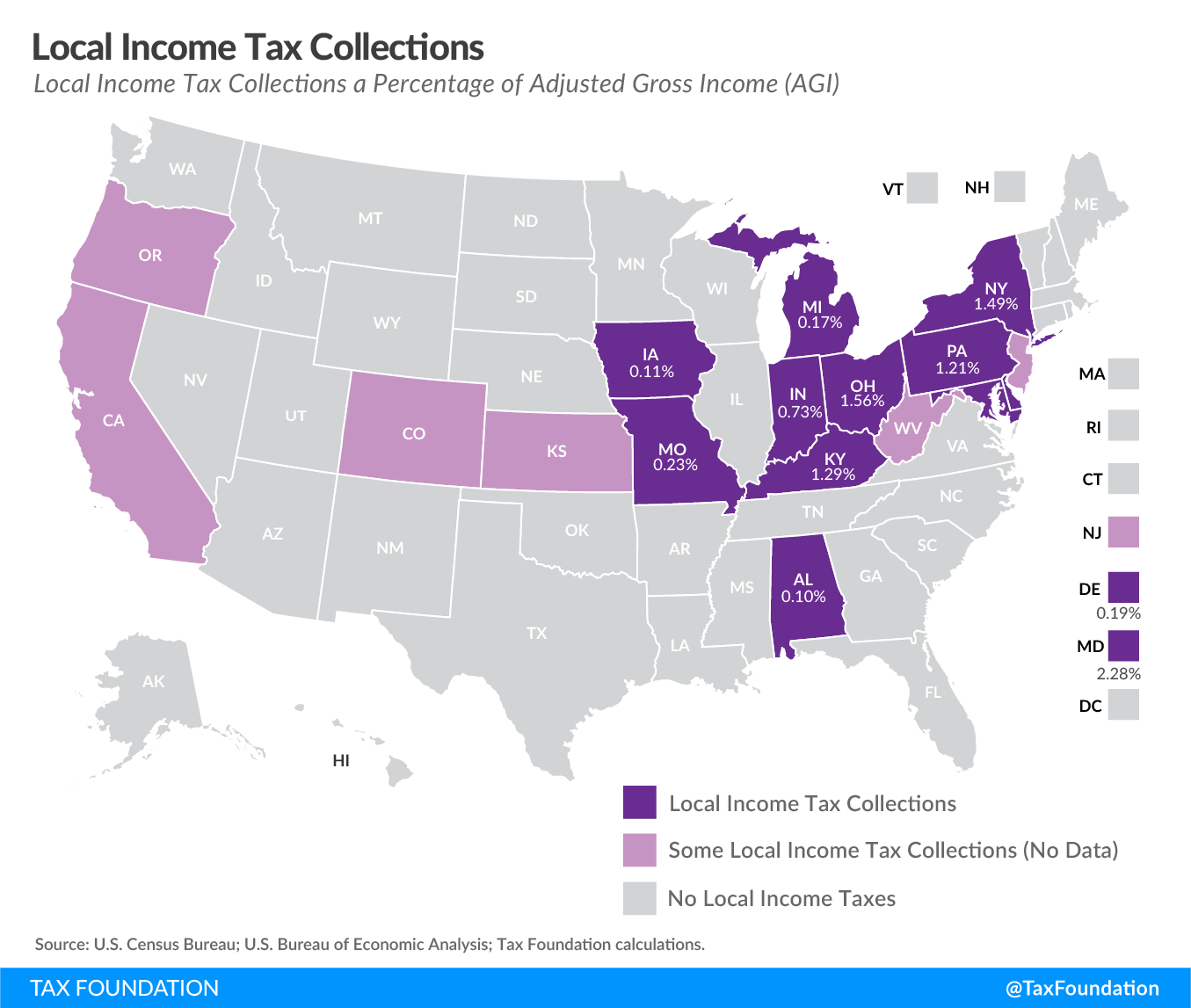

Local Income Taxes In 2019 Local Income Tax City County Level

San Francisco Adopts Major Changes To Business Taxes 2019 Articles Resources Cla Cliftonlarsonallen

Due Dates For San Francisco Gross Receipts Tax

Treasurer Jose Cisneros Facebook

Oakland Voters Expected To Decide Business Tax Hike In November Here S What You Need To Know San Francisco Business Times

San Francisco Gross Receipts Tax Clarification

State By State Guide Which States Have Gross Receipts Tax Taxvalet Sales Tax Done For You

New York Introduces Bill For A 5 Gross Receipts Tax Marcum Llp Accountants And Advisors